Reliable Business Insolvency Company Help for Your Business Requirements

Discover the Various Facets and Procedures Involved in Seeking Insolvency Solutions for Financial Security

Browsing the complexities of insolvency services is typically an essential step towards accomplishing financial stability in difficult times. From deciphering the different kinds of bankruptcy to conforming with lawful procedures and demands, the journey towards monetary recovery is loaded with crucial decisions and ramifications.

Understanding Insolvency Kind

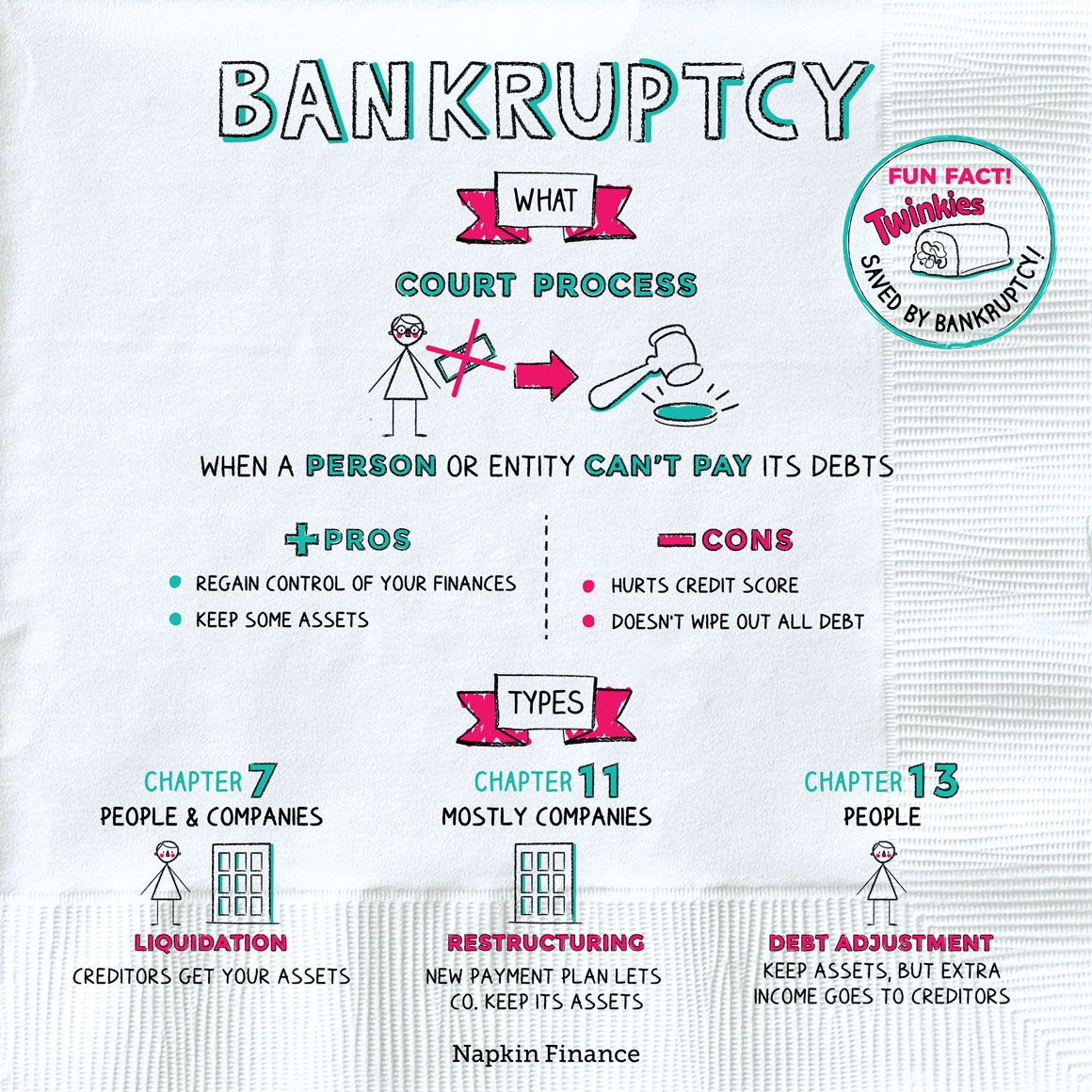

Checking out the different kinds of bankruptcy can offer a thorough understanding of the monetary difficulties individuals and companies might face. Insolvency can manifest in various kinds, each with its very own effects and legal procedures. Both primary kinds of insolvency are capital bankruptcy and equilibrium sheet bankruptcy.

When a private or business is not able to pay off financial debts as they come due,Cash flow bankruptcy takes place. This kind of insolvency indicates that there is a shortage of liquid possessions to cover immediate financial responsibilities. On the other hand, balance sheet insolvency develops when the complete responsibilities of an entity surpass its overall properties. In this circumstance, the entity might have valuable assets, but their value is not enough to balance out the exceptional financial obligations.

Understanding these distinctions is essential for services and people seeking insolvency solutions - Business Insolvency Company. By determining the kind of bankruptcy they are facing, stakeholders can collaborate with bankruptcy experts to create customized options that resolve their particular monetary scenarios

Lawful Procedures and Needs

Navigating the intricacies of legal procedures and needs is crucial for people and transaction with bankruptcy. When dealing with financial distress, understanding the legal framework bordering insolvency is crucial for a successful resolution. One key aspect is determining the ideal insolvency procedure based upon the details situations of the debtor. This could involve filing for bankruptcy, proposing a debt repayment plan through an Individual Voluntary Setup (IVA), or selecting a Business Voluntary Arrangement (CVA) for services.

In addition, abiding with lawful requirements such as giving accurate monetary info, going to court hearings, and complying with bankruptcy specialists is vital throughout the process. By adhering to the lawful procedures and needs vigilantly, people and companies can navigate the bankruptcy process successfully and function in the direction of accomplishing financial stability.

Effects of Bankruptcy Actions

Comprehending the ramifications of insolvency activities is essential for businesses and people seeking financial stability. In addition, insolvency activities can lead to damage in credit score ratings for people and organizations, making it testing to protect fundings or credit history in the future. Bankruptcy may likewise result in lawful actions taken versus the entity by financial institutions to recuperate financial obligations owed.

Working With Bankruptcy Professionals

In partnership with skilled bankruptcy specialists, people and companies can properly navigate complex monetary obstacles and discover strategic services for lasting recovery. Bankruptcy specialists bring a wide range of proficiency in financial restructuring, insolvency legislations, arrangement strategies, and court procedures to the table. Their advice can be crucial in examining the economic situation, recognizing viable alternatives, and creating a detailed strategy to resolve bankruptcy problems.

Collaborating with insolvency specialists includes an organized approach that typically starts with an extensive assessment of the monetary condition and the underlying reasons for bankruptcy. This assessment helps in formulating a tailored technique that straightens with the details needs and objectives of the private or business facing bankruptcy. Insolvency specialists additionally play an important function in promoting communication with creditors, working out settlements, and representing their clients in legal proceedings if essential.

Getting Financial Stability Via Bankruptcy

Given the calculated support and expertise supplied by bankruptcy individuals, experts and businesses can now concentrate on executing actions targeted at safeguarding financial stability through bankruptcy proceedings. Bankruptcy, when www.business-insolvency-company.co.uk/ taken care of successfully, can offer as a device for restructuring debts, renegotiating terms with financial institutions, and eventually recovering economic wellness. Via insolvency processes such as debt reorganization, liquidation, or restructuring, people and companies can resolve their monetary challenges head-on and job in the direction of a sustainable economic future.

Safeguarding monetary security via bankruptcy needs a comprehensive understanding of one's economic situation, a sensible evaluation of financial debts and possessions, and a critical strategy for moving on (Business Insolvency Company). By working very closely with bankruptcy organizations, people and experts can navigate the intricacies of bankruptcy process, adhere to lawful needs, and make educated choices that straighten with their lasting monetary objectives

Conclusion

To conclude, looking for insolvency services entails understanding the various sorts of bankruptcy, complying with legal treatments and needs, and taking into consideration the ramifications of bankruptcy activities. Collaborating with insolvency experts can help individuals and businesses browse the procedure and job towards safeguarding monetary security. It is essential to carefully consider all elements of bankruptcy before continuing to ensure an effective end result and lasting financial health and wellness.

The 2 primary kinds of bankruptcy are cash money flow bankruptcy and equilibrium sheet bankruptcy.

Bankruptcy professionals bring a wealth of proficiency in financial restructuring, bankruptcy laws, negotiation approaches, and court procedures to the table.Working with insolvency specialists involves a structured strategy that generally starts with an extensive analysis of the economic condition and the underlying reasons of bankruptcy.Provided the critical support and competence given by bankruptcy people, experts and companies can now concentrate on executing procedures intended at protecting economic stability via insolvency process.In conclusion, seeking bankruptcy services includes understanding the various types of insolvency, adhering to lawful treatments and requirements, and taking into consideration the implications of insolvency actions.